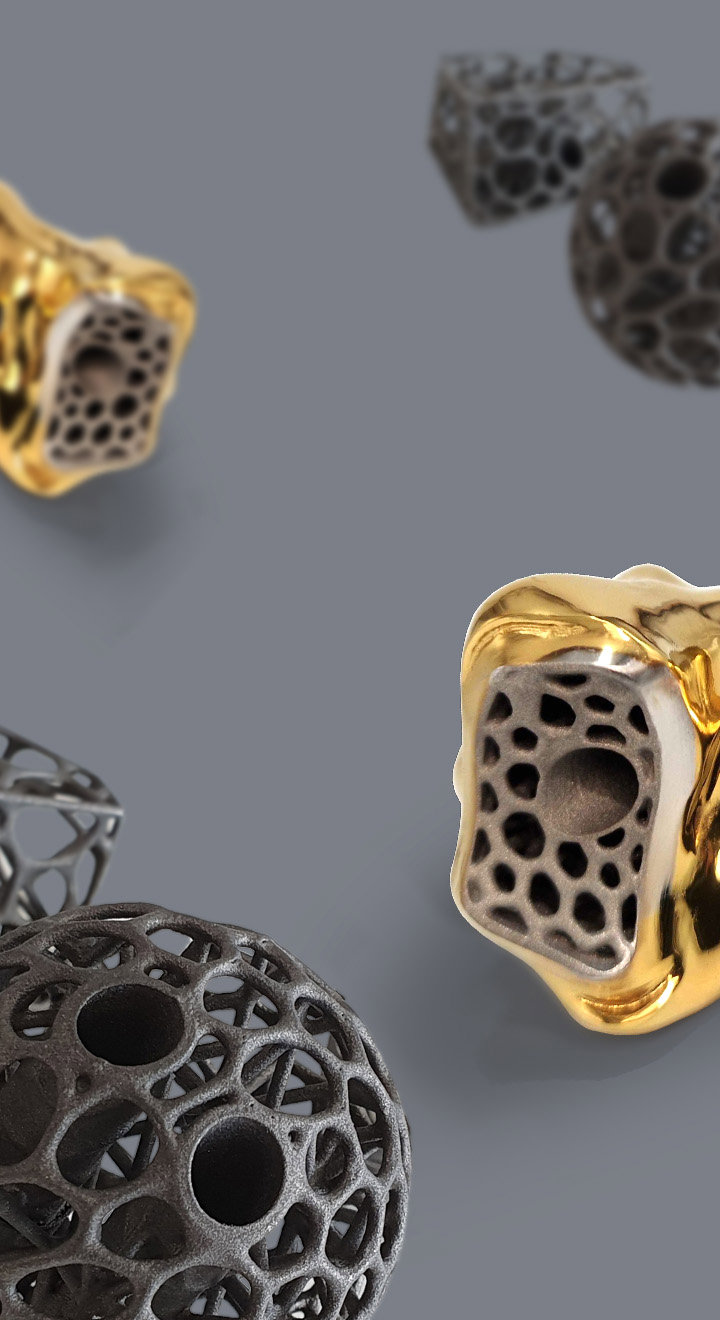

Who are OrthoSolutions

We are a specialist orthopedic foot and ankle company that works in partnership with surgeons to design and develop implants and instrumentation for patients all over the world.

As one of the longest established foot and ankle specialists, we bring more than 20 years’ experience of working with leading surgeons to deliver evidence-based advances that enable better patient results. We back this up with world class training, education and support that helps our surgeons to excel.

System 26 Cannulated Screw System

One screw system. All your fixation needs. Comprehensive extremity screw system that facilitates bone fixation from forefoot to the ankle.

Learn More

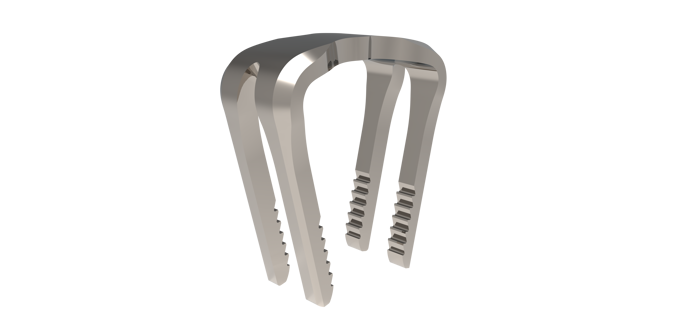

COGNiTiON™ Staple System

COGNiTiON™ STAPLE SYSTEM The staple that redefines strength and stability.

Learn More

Volition™ Ankle Fracture Plating

Evidence based ankle fracture plating solution. Anatomically designed to optimize the treatment of all types of ankle fractures.

Learn More

Volition™ MTPJ and Universal Plating System

VOLITION™ MTPJ and Universal plating system focuses on providing a solution for an array of conditions within the forefoot and midfoot.

Learn More

OxBridge Ankle Fusion Nail

Our retrograde tibiotalarcalcaneal nailing system is designed to provide a secure fusion of the ankle and talar joint.

Learn MoreWhat makes us different

Our goal is to deliver better patient outcomes. It’s a continuous process that never ends. Our refreshingly friendly and nurturing approach encourages and inspires our community of surgeons, healthcare professionals and employees to continually seek better ways of improving patients’ lives.